Comprehensive Guide to the GoMercury Credit Card

Updated: 7 Aug 2024

119

Hi there, are you interested in Gomercury’s financial products, such as the GoMercury Credit Card? If you then appreciate your seeking a reliable option for your banking needs,

If you want to know more about this financial product that comes up with competitive rates and rewards, this guide will be a compass for you. In this guide, I will hold your hand and walk you through everything you need to know about the GoMercury Credit Card.

As a snapshot, you could expect me to tell you its features and benefits and activation procedure during the pre-approved application process and some experts’ tips to make the most out of it, type and help you with the right selection with lots of other latest information.

Overview of the GoMercury Credit Card

So, firstly, allow me to tell you that GoMercury Credit Card is a reliable financial product designed by Gomercury Financial to manage the finances of individuals who are seeking a reliable credit solution. It’s quite straightforward and easily manageable, particularly beneficial for those who may have less-than-perfect credit but are working towards improving their financial standing.

Key Features of the GoMercury Credit Card

Here are some key features that can help you decide if this financial solution could be the right fit for you:

No Annual Fee

One of the primary attractions for the selection of the Mercury Credit Card could be its cost-effective feature, which is that it does not charge a single penny annually for its users.

Competitive Interest Rates

Interestingly, it comes up with competitive interest rates that make it the above choice from other solutions in the market with its lower interest rates compared to other credit card options available in the market for similar customer profiles.

Credit Limit

Another feature of the GoMercury Credit Card is a reasonable credit limit. With it, you can make enhanced and responsible usage. Most importantly, it allows you to increase your credit limit based on your creditworthiness and accountable usage.

Rewards Program

On the surface level, users are also attracted to the rewards program and customizable offers that come with this credit card. It is attractive for users to earn points or cash back on purchases.

Fraud Protection

Gomercurry also protects against fraud and allows users to dispute suspicious and unrecognized transactions. It also allows users to get enhanced security with zero liability protection for unauthorized transactions.

Online Account Management

With this credit card, you can also access a free management account on an online portal or mobile app. With this account, you can easily keep an eye on your spending, transactions, and account activities, make payments, and manage your account efficiently.

Types of Credit Cards offered by GoMercury.com

So, after knowing the features of credit cards offered by Gomercury Financial, you need to understand the different credit cards provided by them so you can decide which one could cater to your finance needs:

Mercury Classic

This mercury classic type of card is designed for users looking for basic features, mostly for new users. With this option, users can build or rebuild their credit history. Mercury Basics features a zero annual fee of 23.99% APR but lacks a rewarding program. As a gist, this is a cost-effective option for new users, allowing them to charge significantly. So it’s a simple card with all the necessary features.

Mercury Gold

Mercury Gold is a reliable option for users who are looking for cards to manage their everyday spending. For this purpose, it allows users to earn rewards for their purchases. Although it also charges a $59 annual fee. The APR is 19.99% for this card, which makes it affordable compared to other available options in the market. So, this card is suitable for more active users, allowing them to earn 1 point for every dollar spent.

Mercury Platinum

As shown by the name, Mercury Platinum is a premium card suitable for users with higher spending needs, so it comes with options that allow users to earn maximized rewards. This card features an annual fee of $99 with premium benefits. The APR is 16.99% with lower interest charges. It allows users to earn 2 points for every dollar spent, which is ideal for those who spend more and want to get more back in rewards.

Here is a quick comparison of the above three options:

| Card type | Ideal Customers | Annual Fee | APR | Rewards Program |

|---|---|---|---|---|

| Mercury Classics | Basic needs and first-time users | $0 | 23.99% | None |

| Mercury Gold | Everyday spending | $59 | 19.99% | 1 point per dollar |

| Mercury Platinum | Higher spending limits | $99 | 16.99% | 2 points per dollar |

| Benefits of the GoMercury Credit Card |

|---|

With this credit card, you can enjoy the following benefits:

|

Application Process for the GoMercury Credit Card

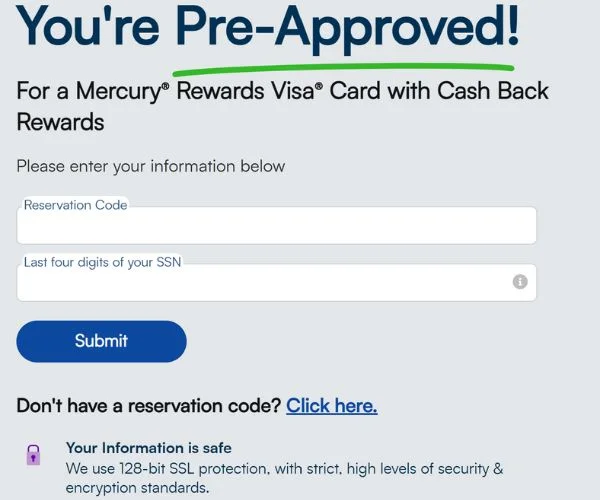

- In case you have a Pre-Approval Offer that you received through mail or email, you will start the process by activating this offer using your reservation code on the reservation activation page.

- Also, you can directly apply online by visiting the GoMercury website and completing your application. For this, it is advised to keep your personal information, including your Social Security number, employment details, and income, close to you because you are going to fill in during the application.

- After filling out the application, it is advised to review your application thoroughly and then submit it for approval.

- Keep on checking your application status.

- Wait for the approval, and you will receive your card within a few business days.

- After getting your card, you need to Activate Your Card.

| Tips for Managing Your GoMercury Credit Card |

|---|

As per the expert’s insights, here are some tips that can help you get the right fit for you with some additional nuggets to have a good experience with your Gomercury card:

|

Conclusion

So, this is all about the financial credit solution offered by Gomercury. This guide will help you build or rebuild your credit, make the right choice of cards, and enjoy an efficient user experience. For further queries, you can hit me up in the comment section, and I would love to answer your concerns. Thank you for reading!